Wealth is the product of man’s capacity to think. – Ayn Rand

This article is part of a series of five articles that will help you to make more effective and sound financial decisions. Here is a list of all articles within this series:

- A Common Sense Guide for Getting Out of Financial Debt

- A Practical Guide for Saving Money

- Ideas to Help You Live More Frugally and Save Money

- Common Sense Guidelines for Managing Money

- Simple Guidelines for Building Long-term Wealth

I’m not a financial planner and so there are no investment guidelines and certainly no stock market predictions to be found within these articles. These articles simply present you with common sense practical ideas to help you become more financially savvy.

Turning Financial Security into Wealth

Over the course of this series of articles, we’ve looked at how to pay off debt, how to save more money, how to live more frugally, and how to be a little more financially savvy. These articles and maps have provided you with the key fundamentals that will help you to take full control over your finances. Moreover, they will help you build a good level of financial security where you no longer need to worry about where your next dollar is coming from.

Financial security will provide you with the flexibility you need to live a very comfortable life with no money worries on the horizon. However, being financially free might not be enough. You might, for instance, have ambitions to significantly increase your income and possibly begin building the foundations for wealth creation.

Attaining financial security is like playing defense on a basketball court. When you play solid defense you minimize your losses by maintaining good control over your finances. On the other hand, wealth creation is very much akin to playing good offense where you look to aggressively maximize the value from all your efforts on the defensive end of the floor. In other words, it’s all about turning your great defensive efforts into even better offensive output. However, in order to make this work in your life, you need to be super aggressive and be willing to take some chances.

The Key Differences Between the Wealthy, Middle Class and Poor

It’s probably safe to say that some people are simply born into wealth. They are born into a wealthy family and therefore have it somewhat easier than the rest of us.

Then there are other people who start with very little, but at one point, a series of fortunate events blesses them with abundant wealth.

It could be said that both of these types people are kind of lucky. In fact, many poor people would consider them to be extremely blessed and fortunate to be in such a strong financial position. They see life as being black or white. You are either lucky or you’re not. Yes, they hope to get lucky, and they hope that they will be rich someday, but that’s all they do. They just hope that things will be better and all the while they fail to consider that building long-term financial wealth might actually have very little to do with luck and more to do with our mindset.

For instance, those who spend their entire lives in the middle class tend to be consumers. They earn, and then they consume. They use their money to purchase liabilities that help them build their status. But no matter how much income they earn they are lousy at building long-term wealth. They certainly appear to be wealthy on the outside, but they are very cash poor. In fact, they often rack up large amounts of debt to cover their ravenous spending habits.

The poor on the other hand are often not the ones sitting on a pile of debt. They are usually the ones living paycheck-to-paycheck just trying to survive to put food on the table. They spend their entire lives envying the middle class who appear to have it all, but as we’ve already discussed, that couldn’t be further from the truth.

Real wealth isn’t built upon luck or fortunate occurrences. It’s rather built upon how we think about money and how we manage it over the long-run.

Wealthy people become wealthy because they focus on building wealth rather than on accumulating liabilities. They understand that the value of a liability diminishes steadily over time, while on the other hand, assets increases in value. They, therefore, preference investing in assets rather than in liabilities, which helps them build long-term financial wealth. [see: Rich Dad, Poor Dad]

The path toward the accumulation of wealth comes through the daily choices we make. Where to spend our money and what to invest in doesn’t always translate into a clear-cut decision. We must take the time to think things through carefully before taking the plunge. And this is where sound decisions must be made that pull us away from the instant gratification traps that catch so many people unawares.

A typical sound financial decision often expands in the following way:

- Conduct some background research into this financial decision.

- Weigh up the pros and cons of each choice you have before you. This also means taking into consideration both the short and long-term consequences of this decision.

- Gain some feedback or expert opinion from people with experience and knowledge in this area.

- Sleep on it to ensure that you don’t make an emotional decision.

- Make an educated decision.

This process of steps might be a little different in some situations, but for the most part, sound financial decisions evolve in this way. In fact, these are the exact steps that wealthy people typically take before deciding whether to invest in an asset or a liability.

However, growing wealth over the long-run isn’t just about choosing assets over liabilities, it’s about so much more.

Wealthy people see themselves as a vessel for wealth, and thereby cultivate a wealth attraction mindset. They subsequently invest in themselves through lifelong education that helps them gain more knowledge about money. Likewise, they invest in building relationships with people who can help them get to where they want to go faster.

Wealthy people are also extremely resourceful. They will take advantage of opportunities that others typically overlook. Whether that means investing in a business, stocks or real estate, makes no difference. They are just very mindful of everything that’s going on around them, and can, therefore, capitalize on opportunities as they arise.

Wealthy people are also often providing tremendous value to others through the work they do. In fact, they always over deliver and are extremely proactive in the way they conduct themselves. They understand their personal strengths and make full use of them in every situation. It could even be said that they are constantly thinking of new ideas that might help them add further value to those they serve.

While other people are complaining about not having enough, wealthy people understand the value of asking questions. They for instance ask:

How can I add more value to others?

How can I fill an expanding need?

What problems do others have that I can solve?

In what ways could I leverage my money?

The questions they ask have nothing to do with satisfying their own needs, but rather about how they can serve others better. They understand that the more value they can give to others, the more value they will eventually receive in return.

Given this, it’s clear to see that building long-term wealth requires first, understanding how to manage your money, and second, using that money wisely over the long-run.

Why You Will Never Be Wealthy…

Many people of course dream of being wealthy, but have you ever wondered how so very few of them actually attain real wealth? Why is that? What prevents these people from building wealth over the long-run?

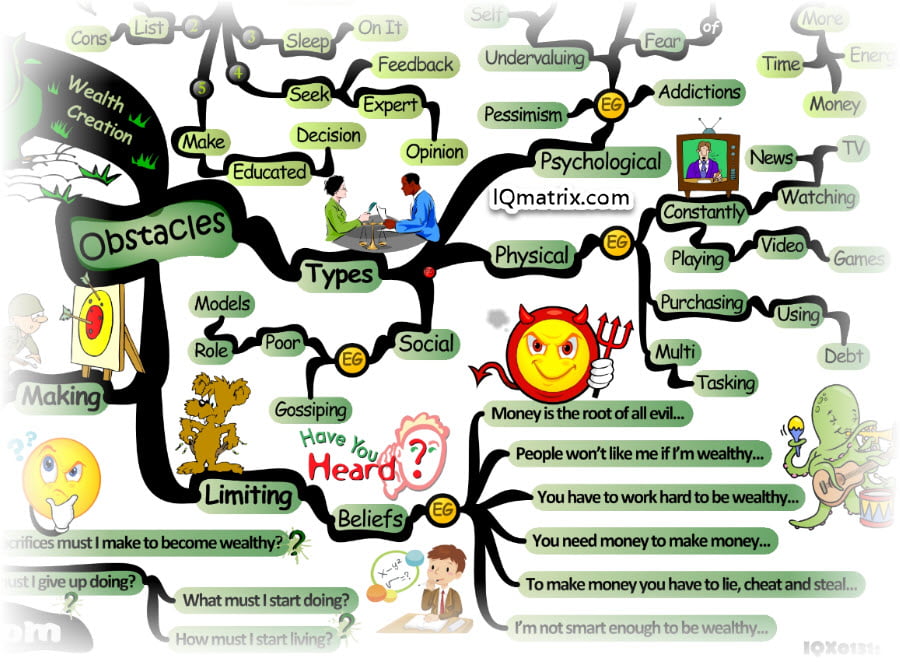

Well, there are actually three key obstacles that often get in people’s way. These obstacles come in the form of Psychological, Physical and Social roadblocks.

You might, for instance, be extremely financially savvy, however, you will fail to accumulate long-term wealth because one or more of these obstacles — will at one point or another — hinder your progress.

Let’s now take a look at each of these obstacles in a little more detail.

Psychological Financial Obstacles

Psychological obstacles are all about our state-of-mind and how that influences how we view money and the accumulation of wealth. For instance, you might have numerous limiting beliefs about money. These beliefs have been ingrained into your psyche over the years as a result of the various influences you have had over a lifetime.

The beliefs you have about money subsequently influence every decision you make about money — for better or worse. Moreover, these beliefs can often manifest as doubt, pessimism, fear or as numerous unhelpful thinking styles. These manifestations can then add an extra emotional layer to each belief, thereby making them even stronger

Limiting money beliefs might for instance include:

Money is the root of all evil.

People won’t like me if I’m wealthy.

You have to work hard to be wealthy.

You need money to make money.

To make money you have to lie, cheat and steal.

I’m not smart enough to be wealthy.

These beliefs are deeply ingrained in our psyche and often prevent us from making sound financial decisions that could help get ahead financially.

For suggestions on how to work through these beliefs, please see: How to Overcome Your Limiting Beliefs.

Physical Financial Obstacles

Physical obstacles often manifest as habits that you tend to indulge in that pull you away from the things you know you need to focus on to help you accumulate wealth over the long-run.

For instance, indulging in addictions, constantly watching television, playing video games, making rash and emotional purchase decisions are all obstacles that pull you away from the wealth attraction mindset we spoke about earlier.

In order to become financially wealthy, you need to be willing to make some sacrifices. These sacrifices might include watching less television, not playing video games, not making irrational purchase decisions, etc.

When you spend 6 hours per day watching television, you are missing out on reading a book that could help improve your financial situation. Likewise, when you make an impulse purchase decision you are pulling those funds away from a potential investment in an asset that will appreciate over time and help you build long-term financial wealth.

Making sacrifices is all about understanding opportunity cost. Focusing on one thing or spending your money in one area means you are at the same time giving up something else. What you’re giving up might not seem so glamorous in the moment, but over the long-term, it will help you to build wealth.

Making sacrifices isn’t easy, but you always need to give up something in order to get something more valuable in return. Ask yourself:

What sacrifices must I make to become wealthy?

What specifically must I give up doing?

What must I start focusing on in order to become wealthy?

How must I begin living my life in order to build long-term wealth?

Hidden within the answers to these questions are the steps you will need to take to begin moving toward your financial goals.

Social Financial Obstacles

The final set of obstacles comes in the form of “people”. In other words, it’s all about the people you associate with and how you interact with them.

It is said that we are the sum total of our five closest friends. In other words, if you were to mash together your five closest friends into one single person, then that person would be YOU!

All your friend’s beliefs about money, all their fears about money, all their money habits manifest in the person you look at in the mirror each morning. If that’s too shocking to think about, then just maybe it might be time to begin making some new friends.

Your closest friends have a huge influence on every aspect of your life. Likewise, you also influence them in the same way. So theoretically you could raise them up to your level of thinking about money, however, that will take a great deal of effort on your part, and there are no guarantees they will change. And if they don’t change, then it’s likely they will eventually bring you back down to their level.

The solution is to start associating with people who have the beliefs, attitude, and habits you want to cultivate in order to build long-term wealth. Use these people to raise you to a higher level of money consciousness. Only in this way will you truly free yourself from any limiting beliefs that might currently be keeping you stuck in the present moment.

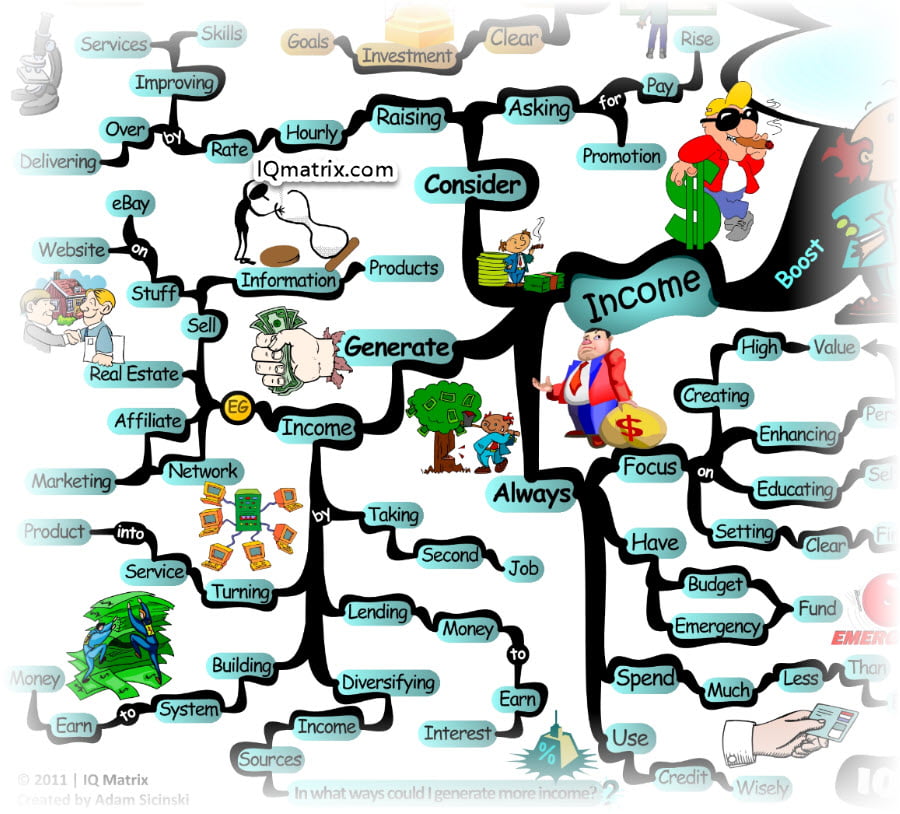

Guidelines for Boosting Your Income

One of the best ways to begin building long-term wealth is through boosting your income. The more money you have coming in the greater flexibility you have to make sound financial decisions. But unfortunately for the typical person, this might be a little bit of a stretch. It’s difficult because they work a regular 9 to 5 job and they’re on a fixed level of income.

Many companies these days value work ethic, a positive mental attitude, and results. If you can figure out how you can contribute to boosting your company’s bottom line, then you have a right to ask for a raise and/or a promotion. But if for any reason that’s not on the cards, then don’t fear because there are other options still left on the table. 🙂

Wealthy individuals are often people who have educated themselves about money. They understanding money and know how to build long-term financial wealth. More specifically, they understand how to budget; they have an emergency fund in place; they spend much less than they earn; they use their credit cards wisely, and they set clear financial goals that help them build long-term wealth.

Whether you’re working a 9 to 5 job, or not, boosting your income begins with the above-mentioned fundamentals. It begins with looking after the money you already have — to the very best of your ability — so that you can use what’s left over (after necessary expenses) to help you build long-term wealth.

Once you’ve got those bases covered, it’s time to think through how to potentially boost your weekly income.

The best way to begin thinking about this is by focusing on how you can potentially provide more value to your customers or to the company you work for. By giving more value you become more valuable, and can, therefore, ask for a raise or charge more for the services and products you offer. This all essentially boils down to over-delivering and going beyond what’s written down in your job description.

Going the extra mile separates you from everybody else and makes what you offer exponentially more valuable to the people you serve. Remember though that value also comes from your knowledge and through the skills you master. The more you invest in yourself and in your own education and development, the more valuable you become and the more you can ask for; or subsequently charge.

With all this in mind, let’s now list some other ways you could potentially boost your weekly income:

- Get a second job with shorter hours but higher pay.

- Sell stuff on eBay or through your own website.

- Sell other people’s products through affiliate marketing.

- Join a network marketing company and sell their stuff.

- Create and sell your own information products.

- Consider lending money to earn an interest.

- Work as a consultant, coach or freelancer in your area of expertise.

These days there are many ways to earn extra income without giving up your day job. In fact, an ever-growing number of people are turning their hobbies into side-businesses. They start small and work on their passions in their spare time. Eventually, the income they generate from their side-business surpasses the income they earn from their regular job, and then that is of course when they make the switch.

Get started by putting a system in place for earning more money. Explore your options and start small. Some things will work in your favor, while others won’t, but if you persist you will eventually find something that fits your strengths that you can nurture, grow and develop over the long-run.

The goal here is to raise your level of income. The more income you have coming in each week the faster you can build financial freedom and long-term wealth.

How to Invest Your Money Wisely

Within this final section, I just want to briefly touch upon some investment guidelines that will finish off our discussion about wealth creation. I’m of course not going to give you any specific investment tips about what stocks to purchase and when. Rather, we will focus on the investor mindset and the actions an investor needs to take to build long-term wealth.

The way I want to look at investments is to treat them as assets. In order to grow long-term wealth, you need to invest in assets that will appreciate over time. I’m however not here to tell you what assets to invest in. For this, I would recommend reading Robert Kiyosaki’s Rich Dad, Poor Dad series of books. There he provides details on how to invest your money in order to build long-term wealth.

I would like to, however, mention that when investing in assets you do need to plan ahead. You need to be willing to conduct enough research into your investment to ensure that you are making a sound financial decision. Moreover, you need to have clear investment goals in place.

Investing and growing your wealth is, of course, a long-term game. To improve your chances of winning at this game you need to start investing as early as possible for an extended period of time. Moreover, sound investments are diversified investments. Putting all your eggs in one basket rarely pays off in the long-run.

Sound investing also requires tracking your progress and having the courage to alter your approach when circumstances change. This is not always easy to do, especially not for the inexperienced investor. As such, it’s of value to have a mentor who can help show you the ropes and guide you through this process.

Smart investing is also about finding ways to save money using tax incentives. This is where a financial adviser or tax accountant can be of tremendous value. But no matter what investment advice you receive, it’s important that you conduct your own research. Don’t just jump head first into an investment based on someone else’s advice. Be especially wary of the advice people give when they have nothing invested themselves. Advice from someone who has nothing to lose should immediately raise red flags.

Above all else, invest wisely, and do so only once you pay off your credit card debts. A bad investment is just as horrendous (sometimes even worse) than spending that money on a liability. At least with the liability, you get something in return. A bad investment, on the other hand, could leave you with nothing, or worse, it might end up costing you more than you initially bargained for. 🙁

Time to Assimilate these Concepts

Did you gain value from this article? Is it important that you know and understand this topic? Would you like to optimize how you think about this topic? Would you like a method for applying these ideas to your life?

If you answered yes to any of these questions, then I’m confident you will gain tremendous value from using the accompanying IQ Matrix for coaching or self-coaching purposes. This mind map provides you with a quick visual overview of the article you just read. The branches, interlinking ideas, and images model how the brain thinks and processes information. It’s kind of like implanting a thought into your brain – an upgrade of sorts that optimizes how you think about these concepts and ideas. 🙂

Recommended IQ Matrix Bundles

If you’re intrigued by the idea of using mind maps for self-improvement then I would like to invite you to become an IQ Matrix Member.

If you’re new to mind mapping or just want to check things out, then register for the Free 12 Month Membership Program. There you will gain access to over 90 mind maps, visual tools, and resources valued at over $500.

If, on the other hand, you want access to an ever-growing library of 100s of visual tools and resources, then check out our Premium Membership Packages. These packages provide you with the ultimate visual reference library for all your personal development needs.

Gain More Knowledge…

Here are some additional links and resources that will help you learn more about this topic:

- 5 Powerful Ways to Change Your Wealth Programming @ Forbes

- 5 Ways Your Family Can Create and Build Wealth @ Forbes

- 7 Powerful Ways to Use ‘Good Debt’ to Create Wealth @ LinkedIn

- 8 Money Mistakes to Avoid on Your Way to Being Wealthy @ Entrepreneur

- 8 Ways to Build Wealth Like Millionaires do @ Forbes

- 9 Habits that will Help You Build Wealth on a Small Salary @ Business Insider

- 9 Ways to Build Wealth Fast @ Forbes

- Creating Wealth is Different from Maintaining Wealth @ Entrepreneur

- How Average People Create Wealth @ Huffington Post

- This Strategy Could Make a Millionaire Out of Almost Anyone @ Business Insider

- Understanding How Opportunities Create Wealth @ Forbes