The safest way to double your money is to fold it over and put it in your pocket. – Kin Hubbard

This article is part of a series of five articles that will help you to make more effective and sound financial decisions. Here is a list of all articles within this series:

- A Common Sense Guide for Getting Out of Financial Debt

- A Practical Guide for Saving Money

- Ideas to Help You Live More Frugally and Save Money

- Common Sense Guidelines for Managing Money

- Simple Guidelines for Building Long-term Wealth

I’m not a financial planner and so there are no investment guidelines and certainly no stock market predictions to be found within these articles. These articles simply present you with common sense practical ideas to help you become more financially savvy.

The Four Pillars of Saving

Do you think short or long-term about your savings plan? Do you save for a rainy day? Do you have money put away for unexpected expenses? Do you have an emergency fund? Do you have a budget in place? What about your home and car? Do you have a savings plan for both? And then there’s your lifestyle. How do you save money there so that you have more left over at the end of each week?

Possibly none of the above really matters. Possibly you haven’t really taken the time to consider how to save money. And just possibly, you might be throwing away thousands of dollars per year just because you never took the time to think this through carefully in the first place.

Many people accept the notion that saving money is a good idea, however, their thoughts and actions are miles apart in agreement. They want to save money, but they just can’t resist life’s temptations. Now of course, at times people do make an effort to save money, but for the most part, their efforts are in-vain as the next temptation rolls around.

Getting into the habit of saving money isn’t easy. It requires a different sort of thinking that leads to significant changes in how you live and in the decisions you make throughout the day. However, if you desire to achieve long-term financial freedom, then saving money is something you must commit to doing consistently each day. In fact, it’s the very first step toward helping you take control of your finances.

In this article, we’ll explore the four pillars of saving. First, we’ll look at how to save money in general. This is all about financial management and finding ways to keep more money in your pocket. Secondly, we’ll explore how to save money on your car expenses. Thirdly, we’ll break down how to save money at home, and lastly, we’ll pick apart the lifestyle choices we typically make and explore ideas on how to save money there as well.

Keeping More Money in Your Pocket

The first Pillar is all about keeping more money in your pocket. This is money that you typically need to spend that doesn’t necessarily fund your lifestyle. In fact, it’s money that is typically wasted away before you even get a chance to spend it on living expenses. I’m of course referring to credit card fees, banks fees, taxes, etc.

Take Control of Your Credit Cards

Okay, so you made a few mistakes in the past and maxed out your credit cards. You have now learned from those decisions, but you are still suffocating in credit card debt.

You obviously have no choice but to pay off your credit cards. In fact, the sooner you pay these debts off, the better. However, you’re kind of struggling with your payments. Instead of whining about it, why not take it upon yourself to have a chat with your bank to lower your interest rate? And if they decide not to budge, then simply take your business somewhere else where they offer you possibly a lower rate or even an interest-free period.

Next, consolidate all your credit card debts onto one card with the lowest interest rate, then cancel all other cards. Choose instead to use debit cards when making purchases.

Taking these steps could potentially save you hundreds and maybe even several thousands of dollars per year in interest fees.

Take Control of Your Bank Fees

As was the case with your credit cards, you are probably also being charged unnecessary or overinflated bank fees. ATM fees, transaction fees, monthly account keeping fees, etc. In isolation, these fees might not seem like much, but they do all add up.

The bank fees you are paying may very well be negotiable or at the very least flexible enough for you to make some changes.

Have a chat with your bank account manager and discuss how you can potentially restructure your bank accounts and your withdrawing habits to help you save money. They will be more than happy to help you out and will provide you with suggestions on how you can reduce these fees. And of course, if you’re not satisfied, then shop around and find a better deal.

Take Control of Personal Taxes

Most of us take tax time for granted. We pay what we are meant to pay and we rarely if ever question whether or not we could have paid less.

Have a chat with a tax accountant and explain your situation. Inform them that you would like to discuss ideas for paying less tax. Ask them for suggestions and guidance about what you could use as a tax deduction, and/or how you could potentially spend or invest your money in order to reduce the amount of tax you pay at the end of the financial year.

Being savvier in the way you handle your taxes could potentially save you thousands of dollars per year.

Take Control of Your Bills

We all have bills to pay. However, did you know that most bills you pay are actually negotiable? Many companies treat customers on a case-by-case basis. As such, they will charge customers differently based on their circumstances. They are after all in the business of keeping your business. Even if they receive a little less per month, they still rather have you as a customer than to lose you to their competitor. As long as they are making a profit, they will likely hear you out and possibly provide you with a fairer price.

And if they don’t provide you with a fairer deal, then shop around and take your business somewhere else.

Furthermore, when it comes to bills, don’t waste your money on paying late fees. Late fees translate to money being thrown down the drain. If you can’t pay your bill on time, then give your creditors ample notice. You could even organize a payment plan. As long as they know there is a plan in place and that you’re working toward paying off their bill, then they will likely waive the late payment fee.

Immediately Launch Your Savings Plan

Using all these suggestions you could potentially save yourself hundreds and possibly thousands of dollars per year. All that extra cash you now have on hand must be used in a sensible way. Here is what to do with it.

First of all, set some achievable savings goals and commit to transferring a certain amount of money each week or month into a high interest bearing account. You can call this your savings or investment account, or you can even use it as an emergency fund to give you some leverage when unexpected expenses arise.

What’s more, you can also potentially transfer a certain portion (10 percent) of your paycheck into this account each month. That way you have consistent funds feeding into your account throughout the year. Over time, this account will grow and you can use it to help fund investments and secure your financial future.

Saving Money on Your Car Expenses

Statistically speaking, in the western world, the vast majority of people own a vehicle. It could be a car or even potentially a scooter or motorbike. No matter what kind of vehicle it is, it’s most likely going to be one of your biggest ongoing expenses. In other words, it constantly drains money out of your pocket each week with ongoing fuel, maintenance, and insurance costs.

It could be argued that an automobile is a luxury. It’s certainly something that many could do without, but the inconvenience that this would cause could potentially jeopardize a person’s income, i.e. their ability to get to work each day. However, there are ways to save money without going to the extremes and selling your car. Let’s explore these ideas below.

Vehicle Maintenance is Paramount

An unmaintained vehicle is nothing more than a waste bin for money. Servicing your vehicle regularly will most likely be far more cost-effective in the long-run than paying for service and parts when things break down. It’s also safer to drive and possibly will help you avoid unexpected medical costs that arise from car accidents that result from malfunctions.

Vehicle maintenance also encompasses little things such as making sure you are driving with the optimal tire pressure. When your tires are too flat there is more drag and contact with the road, which makes the vehicle’s engine work harder, which subsequently burns more fuel and throws money down the drain.

Save Money on Insurance

Maintaining your vehicle is obviously important, but so is insurance. Yes, there are many people who drive around with no insurance coverage. And yes, they certainly save money in the short-term. With no accidents, they have nothing to worry about. However, what are the guarantees?

Vehicle insurance gives you peace-of-mind just in case you are involved in an accident. Yes, it will take money out of your pocket that you could have instead used to pay off your credit cards, or deposited into your emergency fund or savings account. However, it’s important to remember that when you’re involved in an accident “where you’re at fault”, you’re not only paying for the repair of your own car, but also for the repair of the other vehicle you banged up.

It is, of course, important to shop around for the best insurance deal. What’s more, you can also negotiate with your current provider for a better price. Possibly you currently have an “Under 25 Driver” option on your account that adds 20 dollars to your policy each month. Possibly that’s something you could do without. In this way, you could potentially save yourself a few hundred dollars per year. However, be careful not to reduce your options to such a level that you’re barely covered in case of an accident.

Avoid These Money Wasting Driving Tendencies

Owning a vehicle is fantastic. It takes you from A to B, however, the fuel can also cost you an arm and a leg. 😉 However, there are several simple things you can do that will help make your vehicle far more economical and efficient.

For instance, did you know that using air-conditioning can reduce the fuel efficiency of your vehicle by up to 10 percent? This is especially true at lower speeds. It, therefore, makes more sense to open a window while driving slowly in the suburbs. However, at higher speeds, the open window can create drag which also lowers the fuel efficiency of your car. In such instances, at higher speeds (on freeways) it makes more sense to pump up the air-conditioning rather than opening a window.

You will also burn fuel faster if you drive very erratically. By erratic, I mean braking often, accelerating quickly, and weaving aggressively in and out of traffic lanes. Choose instead to slow down and steady your driving. This will help you to save fuel costs in the long-run.

Save Money by Being a More Savvy Driver

Here are some further suggestions to help you save on fuel costs:

- Avoid driving during rush hour traffic.

- Use cruise control to smooth out your driving.

- Remove excessive weight from your car, especially from the trunk.

- Minimize idling time at traffic lights.

- Consolidate all your errands into one trip.

These are all very simple and straightforward ideas. So straightforward in fact that it might seem as though these changes won’t make much of a difference, however over the long-run you will be putting more money right back into your pocket.

Choosing Alternate Transportation Options

Owning a vehicle is expensive. Not only are there maintenance costs, insurance fees, fuel expenses, but there are also registration fees. If you are serious about saving money, then you could choose to go without your vehicle for now and commute by riding your bike or using public transport.

Alternatively, if you prefer to hold onto your vehicle, then you could consider carpooling with a work buddy. That way you will potentially cut your fuel expenses in half over the course of a year.

Saving Money Around the Home

There are plenty of simple things we can do around the home that can help us to start saving money. Within this section let’s explore three major home-related expenses and the small changes we can begin making that will keep more money in our pockets.

Save on Your Water Expenses

We use water every day. We take showers, wash stuff, do the dishes, water the lawn, use the toilet, cook, and we even drink this stuff. Given this, water is a big part of our lives and — unless you’re living in the country — unfortunately, it’s not something we get for free from mother nature.

Learning how to manage the water you use more effectively can help you to save a considerable amount of money over the course of a year. Consider for instance the following water saving ideas:

- Wash your clothes less often.

- Reduce the amount of lawn watering days.

- Install a smart sprinkler system.

- Take shorter showers and challenge yourself to use a timer.

- Avoid taking baths that typically consume a large amount of water.

- Half flush the toilet instead of the regular full flush.

- Turn off water taps when not in use such as while brushing your teeth.

By taking these steps you could potentially halve your water consumption costs and therefore potentially save yourself hundreds of dollars per year.

Save on Your Electricity Expenses

The other significant but necessary expense comes in the form of electricity. However, there are several things you can do to cut your costs here as well. Here are several ideas:

- Invest in adequate insulation to keep your home cool during summer and warm during winter. Less heating and air-conditioning required.

- Don’t set your heating too high, and your air-conditioning too low. Also, be sure to close your windows.

- Install long-lasting energy-saving light-bulbs around the home.

- Turn off unnecessary lights or dim them to save power.

- Unplug electronics and appliances that are not being used.

- Use washing machines and dryers during off-peak times. This is for those who are on-peak and off-peak electricity plans.

In addition to this, you could, of course, negotiate a better deal with your power provider. If they won’t give you a better deal, then simply take your business somewhere else.

By taking these steps you could potentially save yourself hundreds of dollars per year on electricity costs.

Save on Your Rental Expenses

The third significant expense comes in the form of rental costs. Renting a home, flat or apartment is a negotiation. You get what you’re able to negotiate. The better deal you are able to negotiate the less money you will spend on your living accommodations.

You can however also save a considerable amount of rent by living with other people. Sharing your rental expenses with others can be one of the most significant cost-saving decisions you will ever make.

Making Savvier Lifestyle Choices to Save Money

The final Pillar pertains to making savvier lifestyle choices that will help you to save money in the long-run.

When it comes to our lifestyles, there will, of course, be sacrifices that may need to be made. If you endeavor to save money, you will inevitably need to make some sacrifices that initially may not make you feel great about yourself. However, in the long-run, they will help you to save money and potentially get you out of financial debt.

Oftentimes making the smallest of choices can help you to save a lot of money over the course of a year. Let’s now take a look at how that might be possible.

Avoid Wasting Your Hard Earned Cash

Consider for a moment all the stuff you buy over the course of a week. How many of these things are absolute necessities? How many are simply luxuries?

Those biscuits, that chewing gum, that pack of smokes, that six pack of beer, that high priced tea, etc, are all luxuries. Yes, you love this stuff, but what is this “stuff” really costing you over the course of a year? Possibly more than you ever imagined.

You could instead use this money to pay off your debts, to build your emergency fund, or to save it for investment purposes. Is it possible that your smoking addiction or that chocoholic fetish is holding you back from achieving the financial freedom you would like to create?

Another way you might be throwing money down the drain is through gambling, through betting and through purchasing lottery tickets. The gambling, betting and lottery industry thrives because your chances of success are extremely slim. The vast majority lose, while only a minuscule amount win. You have a greater chance of earning more over a lifetime by simply placing your money in a high interest bearing account.

Save Money by Thinking Frugally

Whenever we hear about someone being frugal, we immediately think of them as being cheap. However, being frugal isn’t about being cheap, it’s rather about being financially savvy with your purchases.

For instance, frugal people tend to:

- Prepare home-cooked meals instead of dining out.

- Use a mobile app such as Skype, Viber or Facebook to chat for free.

- Workout in the park or at home instead of paying an ongoing gym membership fee.

- Buy great second-hand quality stuff from other people.

- Buy food that’s on special and close to its use by date.

- Watch sports on television instead of traveling to the game.

- Watch movies at home instead of spending on cinema tickets.

- Borrow books from the library instead of purchasing them from a store.

These are just a few examples of the frugal decisions that people make every day that help them save an ample amount of money over the course of a year. They can then use that money to grow their finances and strengthen their financial position.

Consider Telecommuting

One of the most rewarding lifestyle choices you could potentially make that can save you a considerable amount of money over the course of a year comes in the form of telecommuting.

Telecommuting essentially means working from home. Instead of driving to the office every day, you convince your boss that you can get more done by working from home. Moreover, you need to convince them how this could potentially increase the company’s bottom line (overall profit).

Yes, working from home means that you will be using your own electricity, water, telephone, etc. This will undoubtedly cost you money, but could also be tax deductible or reimbursed by the company you work for. You do however save time and money that you would have normally spent traveling to and from work.

It essentially comes down to weighing up the pros and cons of your situation and figuring out whether this is the most cost-effective option for you moving forward.

Think Health Prevention Instead of Medical Expenses

The final way we can save money has to do with looking after our health.

Many people purchase medical insurance to ensure that they are looked after when they break a body part or fall ill. This is all well and good. Medical insurance is as important, if not more important, than car insurance. A sudden medical emergency followed by an ambulance ride and a 2-week stay at the hospital can cost a small fortune. It’s critical that we protect ourselves from such unexpected emergencies. However, we must also think about this another way.

Instead of giving so much attention to “covering our butts” for medical expenses, we could potentially save ourselves a significant amount of money by looking after our health in the first place.

Exercising regularly, eating a healthy nutritious diet, taking quality supplements, getting enough sleep and rest, avoiding stress, etc, will help us to stay healthy and active until a ripe old age. Of course, there are no guarantees. Anything could happen. However, many people pay dearly later in life for the lifestyle choices they made decades before. They not only pay with poor health but also with their hard-earned cash.

Save yourself money later, by choosing to live healthier today.

Making Small Changes will Help You Get Started

Saving money doesn’t require you to completely overhaul your entire life. Anyone can begin saving money and building their financial future in very simple and gradual ways. All it takes is a little awareness and making a few small changes that will progressively put more money back into your pocket each week. That money can then either go toward paying off your debts or possibly invested in securing your financial future.

The choice is, of course, yours to make. In fact, every choice you make each day comes with consequences. These consequences may not seem significant or evident in the moment, but small things go a long way over the long-haul. The financial decisions you make today to save money may not seem like they matter right now, but over the course of several weeks, months and years, they can be the difference between living in debt or with the satisfaction of financial freedom.

Time to Assimilate these Concepts

Did you gain value from this article? Is it important that you know and understand this topic? Would you like to optimize how you think about this topic? Would you like a method for applying these ideas to your life?

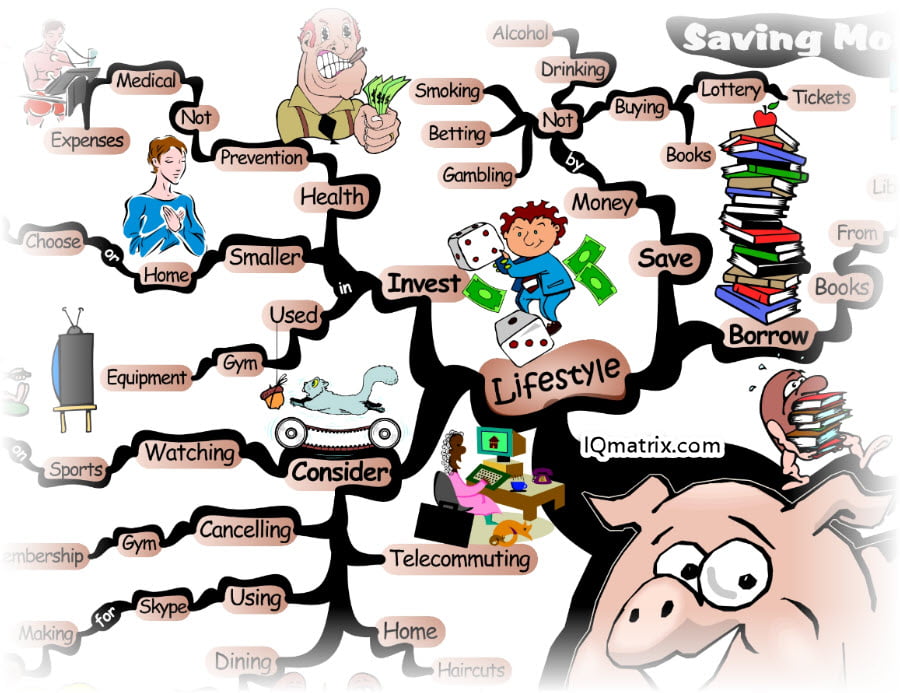

If you answered yes to any of these questions, then I’m confident you will gain tremendous value from using the accompanying IQ Matrix for coaching or self-coaching purposes. This mind map provides you with a quick visual overview of the article you just read. The branches, interlinking ideas, and images model how the brain thinks and processes information. It’s kind of like implanting a thought into your brain – an upgrade of sorts that optimizes how you think about these concepts and ideas. 🙂

Recommended IQ Matrix Bundles

If you’re intrigued by the idea of using mind maps for self-improvement then I would like to invite you to become an IQ Matrix Member.

If you’re new to mind mapping or just want to check things out, then register for the Free 12 Month Membership Program. There you will gain access to over 90 mind maps, visual tools, and resources valued at over $500.

If, on the other hand, you want access to an ever-growing library of 100s of visual tools and resources, then check out our Premium Membership Packages. These packages provide you with the ultimate visual reference library for all your personal development needs.

Gain More Knowledge…

Here are some additional links and resources that will help you learn more about this topic:

- 5 Simple Ways to Save Money Right Now @ Reader’s Digest

- 5 Ways to Jumpstart Your Savings @ Time

- 8 Real Truths About Saving Money Everyone Should Know @ Huffington Post

- 9 Signs You Aren’t Saving Enough Money @ Business Insider

- 16 Savvy Ways to Save Money Every Month @ Forbes

- 17 Simple Ways to Save Money Around the House @ Time

- 20 Simple Ways to Save Money on Groceries @ Huffington Post

- 23 Ways to Slash Your Car Expenses @ Time

- 29 Ways to Save Hundreds on Groceries @ Time

- 94 Creative Ways to Save Money Today @ Greatist

- How to Save Money: 54 Great Personal Finance Tips @ The Week